Georgia and Federal Tax Credits & Rebates

WHAT IS THE INFLATION REDUCTION ACT?

The Inflation Reduction Act (IRA) was enacted by the U.S. government in August of 2022

with the objective of reducing greenhouse gas (GHG) emissions

by 40% by 2030, and it has had the greatest impact in two primary tax areas.

These areas include the Energy Efficient Home Improvement Tax Credit (25C) and the

High Efficiency Electric Home Rebate Program (HEEHRP).

We offer a broad assortment of ENERGY STAR® qualifying products eligible for these programs.

Use the calculator below to see how you qualify.

Frequently Asked Questions tax rebate calculator

Please reach us at atlantaaircompany@gmail.com if you cannot find an answer to your question.

Homeowners, including renters for certain expenditures, who purchase energy and other efficient appliances and products.

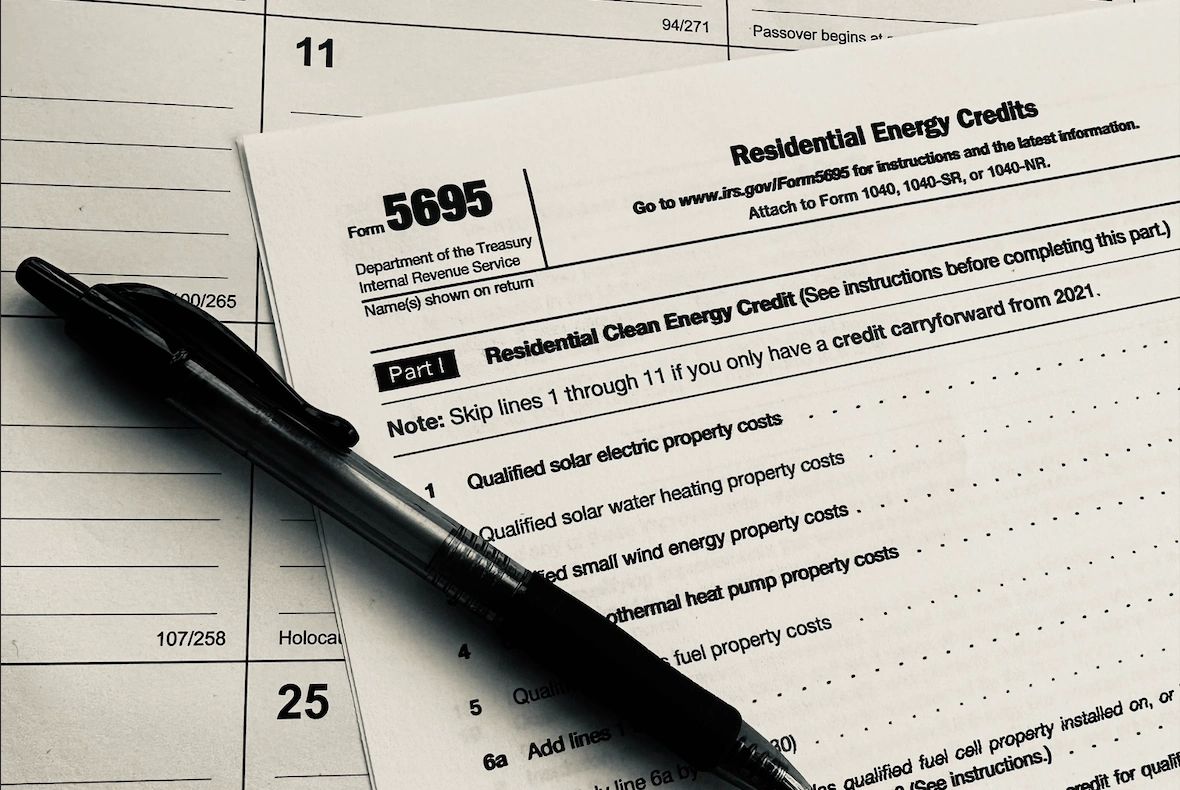

Fill out IRS Form 5695, following IRS instructions, and include it when filing your tax return. Include any relevant product receipts.

Electric or natural gas heat pumps; electric or natural gas heat pump water heaters; central air conditioners; natural gas or propane or oil water heaters; natural gas or propane or oil furnaces or hot water boilers that meet or exceed the specific efficiency tiers established by the Consortium for Energy Efficiency. As well as solar water heating products that are certified for performance by the Solar Rating Certification Corporation or comparable entity endorsed by the state government in which product is installed.

In many cases, no! The IRA’s incentives are designed to increase access to clean technology. For households with lower incomes, up to 100% of appliance and installation costs are discounted at purchase, meaning you could install efficient electric appliances at no cost, with no spending.

Middle-income households do have to spend in order to access savings, but up to 50% of appliance and installation costs can be covered through upfront discounts, and you can use tax credits to cover some of the remaining gap. Highest-income households are not eligible for upfront discounts, so you will have to pay full price for appliances and installation — but tax credits on the back end could recoup up to 30% of your costs.

All tax credits are available now, and you can read the IRS’ guidance on 25C and 25D here. The rebates should start to become available by the end of 2023. We don't know exactly when the rebates marked “late 2023” will be available, because it will depend on how each state rolls out its incentive program.

Contact Us

Able Heating and Air

Hours

Mon | 08:00 am – 06:00 pm | |

Tue | 08:00 am – 06:00 pm | |

Wed | 08:00 am – 06:00 pm | |

Thu | 08:00 am – 06:00 pm | |

Fri | 08:00 am – 06:00 pm | |

Sat | Closed | |

Sun | Closed |